Pensions and COVID 19 – the effects and how to message staff

Another COVID 19 blog post – well, hopefully, it’s another interesting one!

Financial markets have suffered a substantial hit because of Coronavirus, and pensions are just like any other investment which will have dropped in value, leaving pension members rightly concerned about their retirement planning.

Pensions are viewed as long term investments and as such, the younger members shouldn’t be overly concerned with a drop as they have time on their side to recover, but members who are approaching retirement, unfortunately, don’t have that luxury.

The UK’s leading employers will have been proactive throughout this current climate in keeping their members informed about fund performance and guidance on what they should do.

So what can we learn from the financial markets and what are the key messages you should be focussing on in your communication campaigns? (if you don’t have a clear & concise pension communication strategy for COVID, we would strongly urge you to think about adopting one)

The effect of Covid-19

A scenario

FTSE 100 (value of the UK’s biggest companies)

January 2020 – 7,604 points

May 5th 2020 – 5,849 points

THIS IS A DROP OF 23%

Here’s a case study on the impact

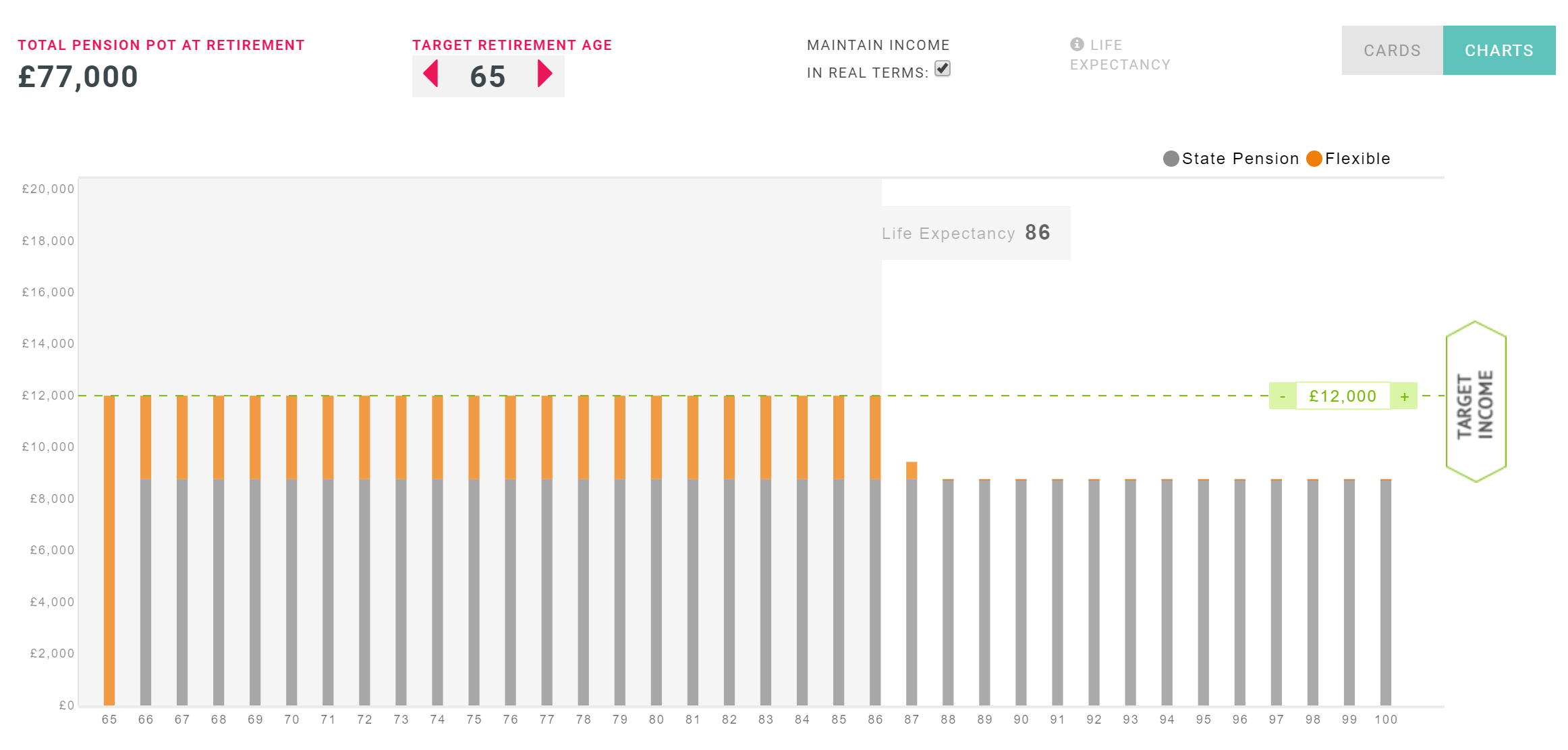

Take John who is planning on retiring imminently, at the start of the year he had a pension pot worth £100k but it has now dropped down to £77k. His target income is £12k per year – take a look at how the drop has affected his retirement planning.

* The below are screenshots from our Retirement Options Planner modelling tool. You can request a demo here.

Based on a pot of just over £100k, John can withdraw approximately £4k each year to achieve his target income. This is forecast to last well beyond his life expectancy.

However, if John’s fund has dropped 23% he would run out of money eight years earlier. John is left with some difficult decisions, he may have to work longer or reduce his retirement aspirations.

How to communicate the effect to your members.

Make sure you’re segmenting your audience when sending communications.

Lemonade Reward are big believers in one message isn’t right for everybody, you should try as best you can to segment your audience as different groups of members will need different messages. For your COVID 19 comms campaign, a good place to start would be:

Younger members (those with 25 years + for retirement)

Pre-retirement members (those with less than 5 years before they plan to retire)

Those making an individual fund choice

Your scheme will no doubt have levels of complexity that we can’t foresee without further information, but this a rough framework.

How to communicate the effect to your younger members

This audience has the luxury of time on their side, although lots of them will be in higher risk profiles which may have suffered significant losses, their retirement is some way off and funds will have time to bounce back.

Key message and information:

’Investments are a long game plan, it is likely you will recover any losses over time.’

use stock market imagery for instance the 08/09 financial crisis (hopefully some of your members will remember that) to demonstrate how markets have recovered since then.

The pensions advisory service have given this note, which is a message all employers & pension managers should support.

“Making decisions about your pension based on short-term events and circumstances can have long-term consequences for your financial wellbeing and retirement. Before making any major decisions about your pension, it is important to get independent guidance or advice.”

How to communicate the effect to your members approaching retirement.

These members will undoubtedly be the ones who are most affected by the sudden pandemic, so extra care needs to be given to this population.

Key message and information:

‘Don’t panic, seek advice, review your situation’

Market recovery - Markets are beginning to recover as more and more countries announce their plans to emerge from lockdown.

Tax-Free Cash - Think about taking less cash now.

Play the waiting game - Consider phasing your pension and give your funds the chance to recover

We would recommend you keep in regular contact with these members to keep them informed and where possible, offer them financial advice sessions as the current financial landscape is anything but normal.

Communicating to those who made their own fund choice

As we alluded to at the start of this piece, financial markets have dropped considerably since the start of the year (23% for the FTSE 100), those who are invested in higher-risk funds could have seen a decrease in fund value over that 23%.

Key message and information:

‘With a decline in markets comes opportunity, you have time to recover losses (for younger members), re-evaluate your fund choice and take a long term view (cashing in now crystalises your losses)’

State pensions are unaffected by stock market fluctuations.

If you cashout funds now, you might miss out on higher values if you wait for markets to recover, this also gives you the option to continue contributing up to £40k per year tax-free.

Find out how we can help you maximise engagement with your members.

We simplify complex topics to communicate in an effective and captivating way, to engage your members in their pension.